BEIJING, July 4 (Xinhua) -- The Chinese government said Tuesday that it will speed up the development of commercial pension insurance.

By 2020, a well-regulated commercial pension insurance system will provide support for commercial pension plans of individuals and families, as well as employee pensions, according to a State Council guideline.

Commercial pension insurance should support the social pension system, promote eldercare services, and support the country's financial security and economic growth, it said.

The guideline sets four tasks, including innovative insurance products and services, and ensuring the sound and safe operation of commercial pension insurance funds.

Insurers should offer personalized services to individuals and households, as well as annuity programs for employers, it said.

It encourages commercial insurers to provide support for the pension system and to take part in investment and management of basic pension funds and the national social security fund.

Huang Hong, vice chairman of the China Insurance Regulatory Commission(CIRC), said the commercial pension insurance is vital in the establishment of a social pension system that is jointly covered by the government, employers and individuals.

To ensure the security of insurance funds, Huang also pledged that the CIRC will make comprehensive evaluations and set a relatively higher threshold when selecting qualified insurers to enter this field.

Insurance regulators will set up particular rules and evaluation system for commercial pension insurance, and encourage insurance funds to go into investment projects and programs with low risks and steady returns, said Huang.

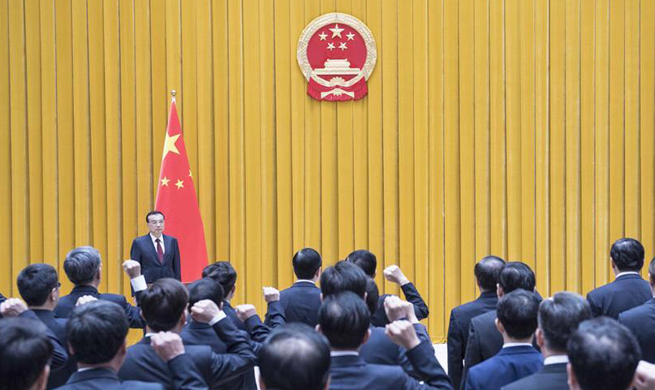

"Commercial pension insurance, just like social security, is a lifeline for ordinary people," Chinese Premier Li Keqiang said at a State Council executive meeting last month.

"We must ensure that the funds are managed safely and reliably. This is the bottom line that every insurance institution should adhere to," Li said.